Blake Taylor

What Is the Best Way to Sell a Profitable Business?

Selling a profitable business is one of the most significant financial decisions you can make as a business owner. A …

7 MIN READ

Read More

Selling your business is a major decision followed by a multifaceted process requiring careful planning and execution. There are many steps involved, from preparing your operations for a sale to marketing and negotiations to reach an agreement on price and terms.

Whether you are buying or selling your business, it’s important to understand the legal and financial factors. This information will help ensure a smooth transition and maximize the value for all parties.

The process of selling any business is unique in specific ways. It’s important that sellers understand that no advisor or Broker can commit to a precise schedule, so be wary of any that do. We see timelines of approximately six to 12 months, but things could happen within only a few months or take over a year. The timeline is based on various factors concerning your company, your industry, and the general market. It’s also important to factor in a necessary transition period when the business is transferred over. No matter the differences in a particular transaction, you can expect to follow certain steps roughly.

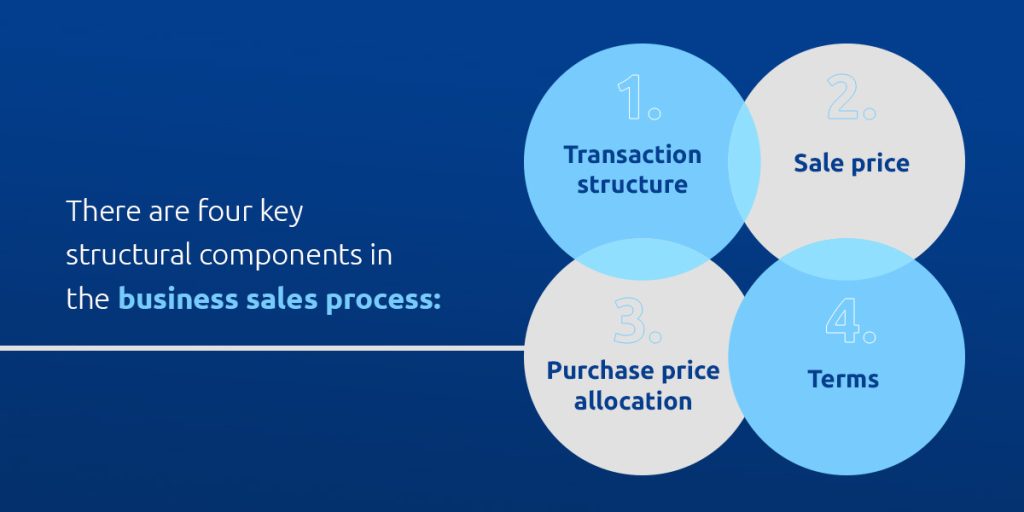

There are four key structural components in the business sales process:

The steps in a business sale process are crucial to ensuring you get a fair price and the transition runs without hiccups. At Synergy Business Brokers, we have a 15-step process that helps you get the best prices for your business.

The very first step in selling your business is considering whether or not selling is, in fact, the right move for you. To help you navigate this tough decision, you should engage in a conversation with professional business brokers. To begin this dialogue, you don’t have to make up your mind that you’re selling. You’ll just talk through options and get advice at this preliminary stage.

A business broker will ask questions about your company to give you a ballpark price for which it is likely to sell. To make this meeting productive, they’ll need to know more about what type of business you own, what your involvement is, annual revenue, employees, customer base, whether or not real estate is included, and which way revenues are trending. From there, your business broker will be able to produce an estimate of what you might receive for your business. That tends to help owners make a final decision about whether or not to sell. Rest assured that all of these interactions will be kept confidential.

Professional business brokers are happy to sign a confidentiality agreement before moving on to this step. In order to get more precise about where to value your business, they will need to dig into financial figures. You can expect to produce three years of tax returns and a profit and loss statement for the current year. It’s also important to understand your total owner’s cash flow, including your benefits, salary, perks and net income. Other financial components that need to be reviewed are inventory, equipment, etc.

An essential part of developing a good selling price is understanding the business from a holistic standpoint. Brokers need to contemplate trends in their field, their competitors, what’s unique about their business, and what are the growth opportunities.

Alongside the financial information you will have provided, brokers can put together comparables for what other such companies have sold for. This step entails presenting a possible asking price and obtaining the owner’s feedback. Is the number in line with what you would be willing to sell for? This is a good point in the process to do a ‘gut check’ and decide whether or not you genuinely want to sell. Ask yourself, ‘Do I want to sell my business for X amount?’ It’s also important to note that the right business broker will be honest about their ability to meet your needs.

Two marketing documents are necessary at this stage. The first one is sometimes called a teaser because it gives potential buyers an overview of your business without specifying which company is for sale. The teaser is typically a one-page document. It will not contain the name of your company or a specific address. It will describe your business in an overview and provide a general location.

For a Buyer to get the details on your company after they review the teaser, they will need to sign a Non-Disclosure Agreement and provide us with information on their background, skills, and financial capabilities. Once the buyer has shown that they are qualified, then we can provide them with a confidential information memorandum (CIM). The document contains specific information about your business and will evolve as we get to know your company better. Though we are experts in creating these documents, it’s essential that business owners are part of the process. After all, who knows your own business better than you?

Many channels can be used to reach the maximum number of potential buyers. These include Google, Facebook, LinkedIn, Bizbuysell, Wall Street Journal’s website, Yahoo, Bing, YouTube, The NY Times website, BusinessBroker.net, IBBA.org, Businessesforsale.com, Dealstream, Bizquest, and our own website. The good news is that we will utilize all of these sites and more if you work with Synergy Business Brokers. It’s helpful to choose a broker specializing in your unique industry since they will have plenty of connections and understand the most effective ways to market your business for sale.

For example, Synergy Business Brokers focuses on technology, construction, manufacturing, distribution, healthcare, services, and engineering firms. In all of these categories, we have numerous buyers that we contact, including public and private companies, private equity groups, and wealthy entrepreneurs who are interested in buying businesses in these sectors. They are also involved in acquiring companies in related industries that they can leverage to grow their business. Their sales and distribution network can often bring your products or services to a broader market.

Private equity groups usually combine one or more synergistic companies in these industries to leverage the strengths of the multiple companies they acquire. Wealthy entrepreneurs seek to acquire companies they can grow by leveraging their skills, experience, and contacts.

You can expect a number of business buyers to be interested. Before providing any details, they must sign a confidentiality agreement and prove their credentials so we know they are qualified. From there, we begin to narrow down the list so we can find the right buyer.

A buyer must have the right skills, motivation, and desire to acquire your specific company. At this stage, we share more details to determine who is the best fit.

Once the potential buyers have the sale details, you move into an initial question-and-answer session. At this phase, your Business Broker will work with interested parties to answer questions about your business. This is also an excellent time to understand their timing and motivation better. These conversations help us continue to refine the list of interested buyers to one who is truly the right fit for your company.

The buyer and seller introduction helps both parties learn more about the business and each other. The seller will confirm whether they are interested, and you can also make up your mind on the buyer as well. We’ll do our best to introduce people that we think you will be comfortable with, but it is your decision at the end of the day. We offer the advice here of being open and honest about your business – the good and the bad.

Naturally, you are passionate about your business and are likely optimistic about the future. To ensure the buyer understands what they are taking over, you should also be prepared to share areas for improvement. In these meetings, we encourage transparency from both sides so that the outcome is favorable to everyone involved.

Once buyers are adequately informed of all the details and feel comfortable with the business, the next step would be for them to submit an offer. You can now consider the price offered with additional variables like due diligence requirements, terms of the sale and how likely we think the buyer is to close on the deal. We will take into account whether they need financing or not, their interest in moving quickly, and more.

When you select an offer, you move on to negotiations. Many companies receive more than one offer, and your Broker should help you narrow down the proposals to one or two where you will begin negotiating. Our focus is on working with the buyers who will be most likely to close on the deal and on obtaining terms that are acceptable to you.

Aside from just price, we will also consider negotiating items like how long of a transition period they want, what due diligence they will be performing, and their plans for running the company. Expect to get into details such as accounts receivable, payables, inventory, and assets.

Once negotiations are complete and the terms are agreeable to everyone, a letter of intent (LOI) is signed. The buyer will usually have a period of up to 90 days to complete due diligence. The signed letter of intent stipulates if the buyer can exclusively pursue your business while both parties invest time in the due diligence process.

The amount of due diligence that each buyer requests varies depending on the size of the deal, the buyer’s background, and the information available. If bank financing is involved, the bank will also require due diligence information. The buyer often has their accountant request and review information from the seller’s accountant. They will have a lawyer look over the contracts that the business has with customers, suppliers, and employees.

Due diligence is designed to confirm that the company is what was stated to the potential buyer by the seller and the Business Broker. Also, new buyers want to see if there are things that could cause problems for them at some point, such as pending lawsuits or a large customer that has canceled their contract. During the review process, the buyer, their attorney, and their accountant will have questions. When the information is reviewed and the questions are answered to the satisfaction of the buyer, the next step in the business sale process is for the attorneys to negotiate the purchase agreement. However, the purchase agreement can be negotiated at the beginning of due diligence, depending on whether both sides want to invest in attorneys at that point.

Typically, the seller’s attorney will draw up the contract and send it to the buyer’s attorney for review. Buyers and Sellers should expect some give-and-take throughout the process of negotiating final terms. Sometimes, attorneys come to an impasse from which an experienced business broker can benefit. They can host a meeting with all parties to mediate and resolve issues. Their goal is to keep the sales process moving forward so that you can schedule a closing date.

This final step in the process can happen in a variety of ways. Usually, the Purchase Agreement is signed before the closing, but sometimes everything is agreed to, and then a closing date is set with the plan of signing the agreement at the closing. The closing often occurs at the buyer or seller’s attorney’s office, with all parties present to finalize the deal and exchange payment. However, sometimes the closing is handled virtually with an electronic copy signed, and the funds are paid via wire transfer to a seller’s bank account.

While there are many steps in the process of selling your company, with the right business broker by your side, these first nine steps can be done within eight weeks or less. Addressing each component, from the transaction structure to the closing steps, helps ensure a successful, equitable transfer of ownership. At Synergy Business Brokers, we only get paid if we sell your business, so we work with companies where we are confident we can help them achieve their goals – and we’ll be transparent if we don’t think we are a good fit. If you feel good about the price we’ve discussed, it’s time to sign an Engagement Agreement and get started.

If you need to sell your business, complete our brief form and one of our experts will reach out for a confidential consultation.