Blake Taylor

What Is the Best Way to Sell a Profitable Business?

Selling a profitable business is one of the most significant financial decisions you can make as a business owner. A …

7 MIN READ

Read More

Are you looking to sell your company in transportation, construction, manufacturing, healthcare, tech, services, or other industry? Regardless of the field, selling a business is a significant financial and emotional decision that calls for a well-structured plan. Taking the steps to plan for things like valuation and taxes can help you maximize value from the sale and hit your financial goals.

We understand all the processes that go into selling a business. Read on as we share our insights and tips for financial planning to make the process more effective.

Financial planning is an important thing you can do before selling your business. It prevents business owners from neglecting their personal finances when selling a business and preparing taxes. Here are some reasons why financial planning is the best way to prepare for your business sale:

Most average businesses take around six to 12 months to sell, which gives business owners sufficient time to prepare. Here are the top factors to consider when you’re planning to sell a business:

Profitability analysis shows a business’s true ability to generate profit. It involves a thorough examination of your business’s revenue streams and costs, making it easier to identify opportunities for boosting your bottom line.

For trucking companies, this process typically considers factors like fuel costs, maintenance expenses and freight rates. The insights from this analysis can help you drive sustainable growth and increase the value of your business before you put it up for sale.

A business valuation creates a holistic picture of a company’s true worth. It shows the value of all its characteristics, such as cash flow or asset inventory.

A business valuation is crucial for business owners looking to sell, merge or purchase a company. It gives you an accurate and transparent picture of your business’s market value. For example, for a logistics company, the valuation might include factors like the fleet, warehouse facilities and customer contracts. It showcases your company’s strengths and potential, providing more insight into its vitality and long-term potential success.

Asset titling is the way to categorize how you own an asset, such as in your individual name or in a trust or entity. Since businesses have many assets and usually each one can be evaluated separately, it’s crucial to title the assets before the sale process.

Understanding your titling options is essential. Trucking companies must carefully title trailers, vehicles and other equipment to optimize tax benefits. If assets are titled incorrectly, it could lead to legal constraints and tax implications or affect estate planning.

It’s a good idea to manage debt and plan for taxes before selling your business. Owners can reduce the burden on the buyer by paying off any existing debt. Doing so can also make the business appear more attractive on the market. Here are the top strategies to implement before your sale:

When selling a business, taxes are one of the key points to consider. It’s important to minimize liabilities to sell your business for the best price and attract more buyers. Companies with fewer liabilities are seen as less risky, which could give you a higher valuation. Tax planning can help legally minimize taxes, especially capital gains taxes. Without a plan, you could lose a substantial portion of your profit to taxes.

It’s important to understand the tax implications of different business structures before making a sale. S and C corporations significantly impact the tax implications of a sale. C corporations generally face double taxation, while S corporations avoid double taxation on corporate income. Here are some of the best strategies to minimize liabilities and reduce taxes on selling your business:

Section 1202, also known as the Small Business Stock Capital Gains Exclusion, is an excellent tool to exclude certain capital gains from select small business stock. These amounts can be removed from federal tax, giving businesses a way to exclude up to 100% of the capital gains from the sale of eligible stock. There are a few requirements for businesses to benefit from Section 1202:

An ESOP is a qualified retirement plan that gives employees an ownership interest in the business. It’s not just beneficial to workers — it’s also a good tax planning option for businesses.

If you sell your business to an ESOP, you can reinvest the proceeds into securities of U.S. companies. You can defer the tax on the gain, and it can also help boost employee morale. There are several benefits of ESOPs for business owners, such as:

A 1031 exchange — named after Section 1031 of the IRS Code — is another technique for lowering capital gains taxes. It enables you to exchange properties for similar properties without incurring immediate tax liabilities. It can be used by business owners or property investors who are looking to sell their property and reinvest the proceeds in another opportunity.

This option is particularly useful for owners looking to sell their business property and start a new venture. It’s only applicable to real properties and doesn’t apply to other business assets. Here are the typical requirements for businesses to use the 1031 exchange:

After selling your business, financial planning can help you achieve a sense of security and aid in estate planning. It’s an important step in being better prepared when you sell your business. An investment strategy is a crucial part of the post-sale financial plan. It helps you make good use of the cash you receive after the sale. You can choose to continue investing in stock in your business or diversify your portfolio further.

Some investment strategies can also bring tax benefits. For example, charitable business owners can gift a portion to a donor-advised fund (DAF) before the sale, which provides an immediate tax deduction and reduces capital gains payments on that portion. Philanthropy planning can save you taxes on the business sale and help protect your wealth, while helping others.

The main goal of a post-sale financial plan is risk management. As part of this process, you may be making amendments to your insurance coverage to secure your valuable personal assets amidst financial changes. You might also be folding some assets into a trust to mitigate potential risks and keep your finances protected in the event of future creditors.

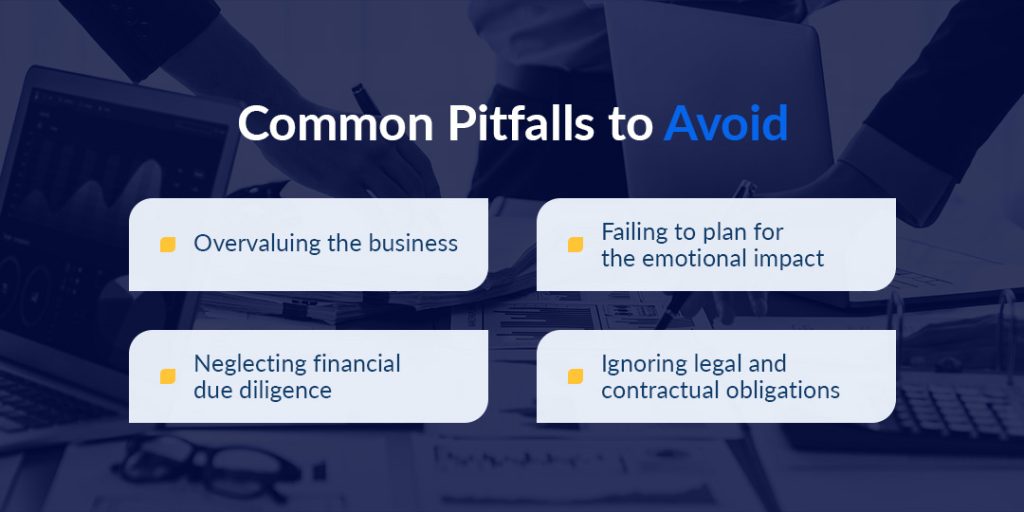

There are many reasons why owners sell their businesses, but regardless of the reason, it’s still difficult to process. Business owners tend to experience some common pitfalls post-business sale, especially with a lack of financial planning. Here are the top examples and ways to avoid them:

Working with financial advisors and professionals can streamline the selling process. They can help unpack the financial considerations when selling a business and provide professional services like tax planning and valuation. Here are the top benefits of working with professionals:

Look for a company that is confident in its capabilities and takes on a smaller number of clients so it can focus deeply on each one. You should also research the size of the database to make sure there are enough active potential buyers, giving you a better chance of selling your business at a good rate.

Synergy Business Brokers was established in 2002 and has since helped many businesses in fields such as technology, logistics and trucking, manufacturing, healthcare and construction. Our high success rate gives us confidence that we will not charge a fee unless we sell your business, so you have nothing to lose. We only work with a limited number of companies at a time, so we can offer maximum effort in marketing your business.

Synergy Business Brokers has decades of experience as the benchmark for mergers and acquisitions (M&A) firms. We consistently deliver unparalleled outcomes for privately held business owners, working tirelessly to reach our goal of providing maximum value. Check out this video to hear from some of our satisfied clients and experienced brokers. If your business has an annual revenue of $700,000 to $250 million, Synergy Business Brokers can help you make a sale you’ll be proud of.

Fill out our Seller Registration Form today and let’s get your company on the market!