Blake Taylor

What Is the Best Way to Sell a Profitable Business?

Selling a profitable business is one of the most significant financial decisions you can make as a business owner. A …

7 MIN READ

Read More

You have worked long and hard to build up your company, and now you are considering retiring. How should you go about selling your business, and what types of fees can you expect to pay? Learn about the different fee types and structures for business brokers or Mergers & Acquisitions (M&A) firms.

This process can cost anywhere from next to nothing to up to 15% of the sale of your business. If you manage to sell your business without hiring a business broker, you only have certain fees and payments for the transaction. Generally, selling your business on your own results in losing more money than hiring a business broker would cost. This is because selling your business on your own usually results in a lower sale price.

Since it is also tough to effectively sell your business without a business broker, you will probably pay a business brokerage fee to sell your business once selling it on your own is unsuccessful. How much it costs to sell a company depends on how you sell it. A business broker’s fees for selling your company can vary, just as the cost to sell a business through an M&A firm will vary.

Brokerage fees vary widely. Some brokers will help sell any business that approaches them, and they typically have an upfront fee or are new to the industry. Other brokers will only sell specific companies. The size of your business and the type of broker will determine the cost of selling your business. Typical business broker commissions and fees are anywhere from 5% to 15% of your business’s sale price.

The average business broker commission is around 10%. That is the general fee average for a business broker. Since the fees for a broker are similar, you should consider other factors beyond cost. When and how you pay that fee depends on the business broker.

Business broker fees vary based on the work being done, the types of businesses that a business broker sells and the level of marketing a business broker performs to sell your business. The fee for a business broker covers the cost of various things in addition to the broker’s hard work and services.

The business broker fee structure can vary depending on the broker. Some disclose business broker fees within the initial steps of the selling process. However, that doesn’t mean you owe those fees immediately — many brokers use this as an opportunity to inform you before the process.

Whoever you work with will often take a percentage as a business broker commission. You will have this percentage stated in a listing agreement before listing your business for sale and will pay it after closing. Some brokers will charge a fee before they sell your business. Here are some of the fees that these brokers may charge as well as other fees you may pay to sell a company:

A retainer fee is a payment made to a business broker to secure their services and cover initial costs. It can either be an upfront charge or a monthly payment, and it’s typically deducted from the success fee upon completion of a sale.

These are fees for completing a business valuation. Valuations are crucial for larger businesses. They offer a clearer picture of the company’s worth, which helps with strategic decision-making, financial reporting and potential transactions like mergers, acquisitions and sales. A valuation also helps establish credibility and trust with investors and stakeholders.

Valuation fees can vary based on a business’s size and complexity. Naturally, larger and more complex businesses need more comprehensive analysis and valuation reports, resulting in higher costs. More in-depth appraisals, like those necessary for legal proceedings and mergers, usually cost more due to the increased financial analysis involved.

If your business doesn’t have an in-house legal team, you will need to hire a law firm to help ensure a smooth, compliant transaction. An attorney’s fees will vary depending on the scope and duration of the work involved. Factors like valuable intellectual property (IP) assets and complex tax regulations can increase legal fees.

Like legal fees, accounting fees can vary widely depending on the complexity of the sale, ranging anywhere from a few thousand to tens of thousands of dollars. These fees cover various tasks, including reviewing financial statements, providing tax advice and assisting with due diligence.

A success fee is paid to the broker following the successful sale of a business. It’s typically a percentage of the sale price, which is agreed upon before the broker is hired. There are different structures of success fees, such as:

The broker fee for selling a business can vary depending on your company’s size and revenue. To determine where your business would fall, look at the three size categories:

The seller is responsible for paying the broker fees, so have a conversation with your broker about future costs. This way, both parties know the payment expectations. Learning about the different types of upfront and post-sale fees from business brokers will help you determine what is best for your situation.

While business brokers use many approaches to charge for their services, the two primary routes are an upfront fee and a post-sale fee. Some business brokerage firms charge an upfront fee and an additional fee when the business is sold. Other business brokers will only charge a fee once your business is sold.

There are different reasons for these approaches. Some are designed to benefit you, and others benefit the broker.

Many advisors request that you pay an upfront fee. From their perspective, it indicates you are serious about selling your company. It also helps them cover marketing and labor costs.

However, is paying an upfront fee really worth it? A brokerage firm with a consistent track record of selling businesses with a commission paid at the closing should be able to cover the costs of the marketing and time invested in selling a business.

Additionally, brokers who are only paid a commission after selling a business will likely only accept assignments when they truly believe they can sell your business. If you are asked to pay an upfront fee, you don’t know if the advisors are actually confident they can sell your company, or if they’re more interested in the upfront fee.

Upfront business broker fees can vary from $5,000 to $50,000 or more, so this can be a significant incentive for someone to take on a new assignment even if they aren’t confident that they can sell it. If a business broker has already received payment for their services, your business may not get the attention it deserves.

If you’ll only pay a fee following a successful transaction, your goal — selling your business — aligns more closely with that of the business broker or M&A firm — getting paid when the business is sold. This drives more motivation to sell your business.

Many Business brokerage firms typically handle deals less than $3 million, and most don’t charge upfront fees. M&A firms often handle transactions of $5 million to $500 million or more. Firms that handle deals of $700,000 to $100 million or more are in the middle range, which involves both business brokerage firms and M&A firms. M&A firms typically charge upfront fees, and business brokerage firms usually do not.

Both firms will speak with the owner and learn more about your business, gathering details about your employees, customers, finances, and unique benefits and challenges. Then, they will recommend a potential selling price.

Typical business sale commissions are 10% of the sale price for companies priced at $1 million or less. For businesses priced over this amount, there’s usually a sliding scale with a lower percentage for larger deals.

Business brokers will need to analyze information and draft documents to market the business. They will usually advertise the confidential overview document online, and potential buyers contact them from there.

Prospective buyers will typically be:

M&A firms and business brokerage firms receive similar types of buyers, but their marketing strategies often differ. This is one of the reasons that the cost of marketing the sale of your business can change between business brokers and M&A firms.

There are generally three ways to market a business for sale:

M&A firms usually use 1 and 3. Business brokers usually use 2 and possibly 1 and 3. We recommend hiring a business brokerage or M&A firm that will use all three methods.

Finalizing a business sale involves a few key steps. The process ensures all agreement terms are met and that the transfer of ownership is properly executed.

It’s essential to review the purchase agreement carefully before signing. All terms should be clearly defined and agreed upon by both parties, including the purchase price, payment terms, assets included, warranties, closing date and any contingencies. Have your attorney review the agreement to verify that everything is accurate.

Your attorney or M&A advisor can help you prepare all closing documents needed to finalize the transaction. These typically include:

Some industries require regulatory approvals to complete transactions. Make sure all approvals are obtained and all required documents are filed before closing. Examples include complying with industry-specific licensing regulations or filing with the federal or state government for changes in ownership.

If the buyer is securing financing to purchase the business, confirm that the funding is in place before closing. Buyers may use loans, cash or a combination of financing methods. Make sure the funds will be transferred through secure methods, like wire transfers or escrow accounts. Consult with your advisor to ensure accurate financial agreements and payment schedules.

This stage involves executing the necessary legal documents to transfer assets and ownership to the buyer. These may include real estate titles or deeds, IP assignments and inventory lists to confirm transferred assets. Once all documents are signed and funds are released from escrow, ownership of the business is officially transferred to the buyer.

Once the deal is closed, you will pay the fee for the services provided — known as the success fee, as we discussed earlier. This fee will be based on the sale of your business.

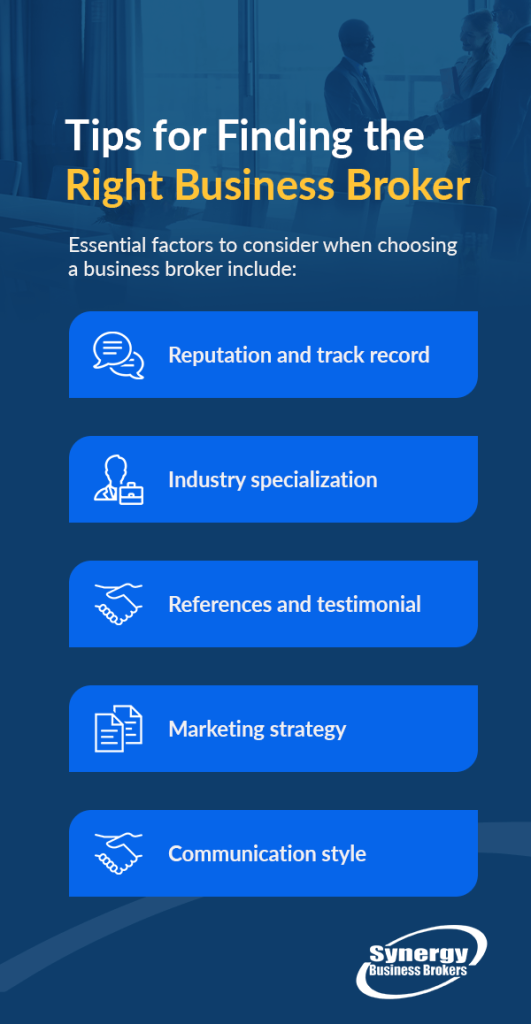

When selecting a broker to help you sell your business, it’s important to choose one who has worked with companies similar to yours, in terms of industry, products and services, and size. Essential factors to consider when choosing a business broker include:

Here are some questions you can ask during a consultation with a potential broker:

We provide the top-level service of an M&A firm without the upfront fee. Our team believes that having only a performance-based fee aligns our goals with those of our clients. By not charging an upfront fee, we can focus exclusively on clients whose price expectations we think we can meet. You can hear from our customers in testimonials and reviews and in our corporate video.

We sell businesses with an annual revenue of $700,000 to $250 million throughout the United States. We have experience selling businesses in numerous industries, including manufacturing, construction, technology, transportation and more.

For a confidential consultation to determine if we can help you achieve your goals, please fill out our Seller Registration form or contact us online. One of our M&A Brokers will follow up with you.