Blake Taylor

What Is the Best Way to Sell a Profitable Business?

Selling a profitable business is one of the most significant financial decisions you can make as a business owner. A …

7 MIN READ

Read More

Is it a good idea to buy a business? Buying a business can be an exciting opportunity, but it comes with risks and complexities. Whether it’s a smart decision depends on several factors, including your experience, finances, industry knowledge and risk tolerance.

It’s important to research your strengths and weaknesses and what you can offer to a business that you would purchase in terms of your skills and passions. Money is important, but it’s also important to be interested in the business that you own. That will spur you on to more motivation and more success. It doesn’t necessarily need to be your first love, but it has to be something you will want to do day in and day out.

If your goal is to own a successful business with a clear path to growth, buying an existing business is a smart move. There are several distinct advantages over starting one from scratch. You’re acquiring operations that already have:

For example, if you buy a manufacturing company with a positive 10-year track record, you likely already have loyal customers, specific knowledge, and experienced employees. You won’t need to spend time trying to create new revenue streams. Instead, you can focus on upgrades and experiment with new product or service offerings.

Buying a franchise means access to built-in support and a structured growth path. You get instant brand recognition, leveraging a name customers know and trust over a wider geographic location. Franchisors also offer extensive training and support. This support typically includes your initial operations and management training, access to proprietary technology, supply chains and software, and ongoing assistance with your marketing, advertising or product updates.

You’re also more likely to get access to financing, as banks see well-known franchises as delivering a higher chance of success. Franchisors may also offer financing options or funding from Small Business Administration loans.

Buying an existing company isn’t without its challenges. It’s crucial to conduct due diligence, get a business valuation from an independent professional, review financial statements, and compare industry benchmarks.

This research will help you pay the right price and avoid reducing your return on investment by overvaluing brand recognition or future potential. You may also face cultural and leadership challenges, making communicating early and often with key stakeholders important. Build trust to ensure a smooth transition.

Before you make an offer, have a clear plan for modernization, like pivoting the business model, rebranding or other ways to improve operations. The business may also be struggling due to outdated technology or changing customer demand. For example, if you buy a company in the service industry with declining requests, you may notice there’s a demand for online bookings, which the company hasn’t yet incorporated. You could set up an online booking system and chatbot to assist customers with basic queries.

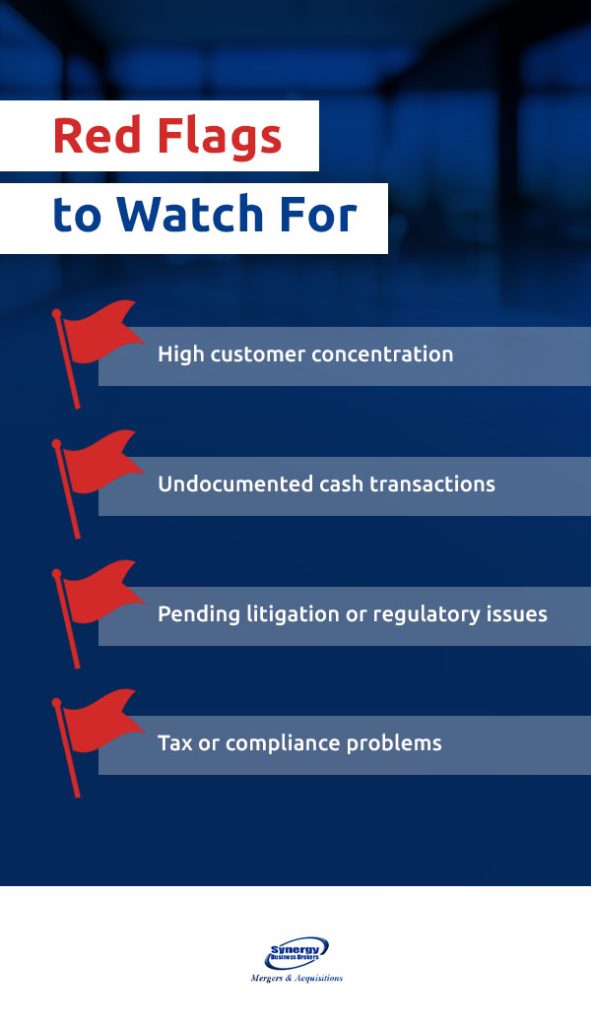

During your due diligence, look out for the following business health indicators:

Factors that may pose a risk to your ownership transition phase include key employee departure rates, vendor contract issues, unrealistic seller expectations and outdated systems or equipment. These indicate a preexisting problem with the business culture, which may affect your ability to successfully run things.

For people who already own a business, it might be a little easier to determine things that you like and don’t like. So, whether or not a business is a good investment in this scenario depends on seeing how the business you will be purchasing can complement your existing business. Will it allow you to reach more customers, provide additional services, add valuable employees, increase efficiencies and share best practices? The more synergy there is between the companies, the more likely it is that the investment will pay off well for you.

Some profitable purchases are made when companies purchase a competitor. In other cases, good investments are made with the acquisition of a supplier or customers. Expanding into a new geographic location through acquisition can also be an effective way to increase your profitability. A complementary acquisition can also be good, such as purchasing a company with a product or services that your customers have been asking for. You can supply this directly to them, creating more reasons for them to do business with you.

With any investment decision, it’s important to review the costs and benefits of the investment. You want to review the last three years’ tax returns and a current year-to-date profit and loss. If you are not fluent in reviewing financial information, then you’ll need to hire an accountant to review the business for a potential investment. They will typically be involved in due diligence and reviewing the numbers to see if they make sense.

There are a number of factors that go into business valuations. For example, determine whether one customer makes up a large portion of their revenue. If so, how long has the customer been with them, and do they have any contracts in place? If not, you need to gauge the likelihood of that company staying with a new business owner. You will want to consider whether the business is increasing, decreasing, or staying relatively stable. And how much of the business is dependent on the owner vs. the employees, and how difficult it will be to replace the owner after he provides a transition to you.

Another thing buyers look for when investing in a business is how much recurring revenue they have. The more, the better. So, for example, in the case of two software companies, one company may have a pricing model that charges for a license based on a monthly or yearly fee. The other software company sells licenses with one upfront fee. Everything else being equal, the company with the monthly licenses will typically be a more desirable investment than the one that sells a license for one upfront fee. However, the price of the business may be higher for the company with recurring revenue.

Companies that have more desirable attributes will typically have a higher valuation and be priced higher. So, it’s not just about getting a low price for a business. You need to weigh the value the business is likely to provide relative to the price you are paying to determine whether it will be a good investment. Of course, every business has some risk. So, there is bound to be some level of anxiety with any major purchase, but you’ll need to get some level of comfort with the risk versus the potential payoff of acquiring the business.

Many people want to know whether buying a business or starting a business is a better investment. Of course, there are trade-offs with both. When starting a new business, you might have less of an upfront expense rather than purchasing a business. But with most existing businesses, you are getting profits from day one.

Keep in mind that 23.2% of private sector companies fail in their first year, so when you are purchasing an existing business that has been established for many years, your risk is much lower, and your expected return on investment is usually greater, with the failure risk being smaller. When buying profitable businesses, you buy a business with cash flow from day one, with existing customers and staff.

| Factor | Buying a Business | Starting a Business |

| Risk Level | Lower risk as the financials, customer base and operations are already established. | Higher risk, as you have no physical proof of concept and many startups fail. |

| Time to Profitability | Faster, since the business is already generating revenue. | Slower, since you need to build a brand, market and attract customers. |

| Brand Recognition | Immediate, as customers already know and trust the brand. | Must build brand awareness from scratch, which can take years. |

| Operational Systems | Established procedures and processes are in place. | Everything needs to be created from the ground up. |

| Financing Availability | Easier to secure financing thanks to an existing track record. | Harder to get loans. Lenders may see startups as high risk. |

| Speed to Market | Immediate, as you step into an operational business. | Slow, since you must develop products, build infrastructure and create demand. |

| Flexibility and Creativity | Less flexibility, as you inherit existing operations and may need to follow established procedures. | More creative freedom, but also more trial and error. |

| Initial Investment | Can be higher due to goodwill and existing revenue streams, but financing is easier. | Can start with less capital, but ongoing costs add up quickly. |

| Failure Rate | Lower. Business survival rates are higher since there is already proof of concept. | Higher. Many startups struggle to survive the first few years. |

Almost all of our businesses are profitable. Our focus is on selling businesses with an owner’s income of $250,000 to $30 Million. You can start by looking at our businesses for sale and see if one piques your interest. If so, please fill out our Non-Disclosure Agreement on the listing of interest. You can sort our businesses for sale by State, Industry, Keyword, Price, or Cash Flow. You can also click on any of the links below that correspond with your interest in location, industry, or price.

At Synergy Business Brokers, we focus on selling businesses in specific industries, so we have keen insight into these sectors and understand how to position companies to sell, which also benefits you, the buyer. These industries include:

If you have a specific price range in mind, filter through the businesses on our sales page according to your budget:

Find Your Next Investment With Synergy Business Brokers

Buying a business is about stepping into a leadership role and making it even better. You can have a quicker path to success than starting from scratch if you have the right strategy.

The business you’re considering should have strong financials and future growth potential, which will be evident when you conduct due diligence. If you have a clear transition and improvement strategy, with the right business brokers, you’ll find the perfect fit.

Synergy Business Brokers is a mergers and acquisitions firm. We help business owners sell their companies and give entrepreneurs a platform to find their next investment. We’ve been in this business for over 20 years and have knowledgeable staff who can help you identify your strengths and interests to guide you in finding the right industry for you.

Contact us today or call us at (888)-688-4664 for more information or assistance with your next investment.