Blake Taylor

What Is the Best Way to Sell a Profitable Business?

Selling a profitable business is one of the most significant financial decisions you can make as a business owner. A …

7 MIN READ

Read More

Mergers and acquisitions drive growth, open new markets and reshape industries. Organizations, investors and CEOs use them to increase value, expand capabilities and achieve their long-term strategic goals. Every transaction carries financial, legal and operational complexity that demands careful preparation and expert execution.

Understanding the M&A process step by step, the types of deals and their impact on stakeholders helps decision-makers act confidently and protect enterprise value. Experienced advisors bring discipline, confidentiality and market insight to each stage, increasing the likelihood of a successful outcome. Owners seeking a practical guide to mergers, acquisitions and business sales gain insight into strategy, valuation and confidential marketing tactics.

Mergers and acquisitions describe two ways companies combine forces. A merger happens when two similarly sized organizations form one company with shared ownership, leadership and branding. When an acquisition happens, one company buys and controls another. The acquired company may keep its name, change leadership or fold entirely into the buyer’s business.

These serve several purposes. Companies use them to enter new markets, gain technology, reduce competition or achieve more cost savings. These moves often reshape industries, create new leaders and open opportunities for employees and investors. For example, a regional hospital network can expand its patient coverage by merging with another, or a large retailer can build its e-commerce capabilities more quickly by buying an online startup.

Both strategies let firms expand faster than relying only on internal growth, but their distinctions affect legal obligations, cultural integration and stakeholder expectations. Treating an acquisition as a merger can create confusion, while labeling it as such can unsettle employees and customers. Clear language from the start helps manage risk and communication.

The mergers and acquisitions playbook has several types, each reflecting a different strategy, risk level and integration challenge. Knowing the categories helps leaders match a deal to their objectives. These M&A types often overlap, and a single deal may fit more than one category. The point is to align the transaction structure with the strategic goal and plan integration accordingly. Successful deals create stakeholder value by balancing financial returns with employee retention and long-term customer loyalty.

A horizontal transaction combines two companies operating in the same industry and at the same production stage. These deals increase market share, reduce competition and create economies of scale. For example, two regional grocery chains could merge to form a larger network with greater buying power.

A vertical transaction links companies at different stages of production or distribution. A manufacturer may acquire a supplier to secure raw materials, or a retailer may buy a logistics firm to control delivery. This approach lowers costs and improves reliability.

A conglomerate is a combination of businesses from unrelated industries owned by one owner. Diversifying across sectors reduces reliance on a single market but adds management complexity. These deals can also reflect strategic shifts into high-growth areas outside the company’s core operations, such as a telecommunications company buying a food processing firm to diversify its revenue base.

In contrast, a congeneric deal unites businesses that serve similar customers but offer different, complementary products — for example, an electronics company acquiring a software developer. They share similar technologies, marketing channels or customer segments. The merger builds complementary strengths without the total overlap of a horizontal merger.

Market-extension transactions bring existing products into new regions or customer segments, while product-extension transactions introduce related products to the current market. Both strategies leverage existing strengths to reach more buyers without starting from scratch.

For instance, a Midwestern logistics provider might merge with a West Coast counterpart to form a nationwide network, expanding their customer base without duplicating infrastructure. Similarly, a bottled water company that merges with a flavored sports drink brand can diversify its offerings while tapping into shared retail channels, marketing and distribution.

Whether geographic or product-based, these mergers reduce the cost and risk of launching something entirely new, making growth more efficient and strategic.

An acquisition-hire focuses on acquiring skilled employees rather than products or revenue. Buyers typically absorb employees, often shutting down or selling off the acquired business’s operation. This strategy helps companies quickly gain specialized skills, fill leadership gaps or speed up innovation in a competitive labor market. These deals appear frequently in tech and startup sectors where talent is scarce. The buyer gains an experienced team and can quickly assign them to work on existing projects.

Retention agreements, equity packages and clear paths motivate the acquired team to stay and contribute after closing. Well-structured acquisition hires combine competitive compensation with meaningful roles to transform a staffing need into a long-term strategic advantage.

Every successful merger or acquisition follows a predictable path. Knowing the stages helps leaders plan, reduce risk and keep deals on schedule. Typically, smaller deals close in a few months, while larger transactions take longer, depending on hidden liabilities and financing gaps. Early planning and clear governance can reduce these risks. Following these 10 steps in an M&A guide reduces risks and increases your chances of success.

Success depends on how you execute each step. For example, sophisticated buyers use data analytics and industry benchmarking to identify targets before competitors do. Sellers who prepare financial statements to investment-banking standards can attract stronger bids and smoother due diligence. Integration planning begins before signing, with metrics to track post-merger success. This proactive approach demonstrates professionalism and signals that leaders have a long-range plan.

Deal structure and financing decide who owns what, who assumes risk and how value transfers after closing.

In an asset purchase, the buyer picks specific assets and liabilities to acquire. It lets the buyer exclude unwanted liabilities and contracts, but sellers may face higher tax costs. Buyers use asset purchases when they want a clean break from legacy risks.

With stock purchases, buyers get the seller’s shares and all attached liabilities, transferring ownership as a whole. Sellers often prefer these deals for tax efficiency and cleaner exits. Buyers accept the added risk or can insist on stronger indemnities and deeper due diligence.

In a statutory merger, two entities legally combine into one surviving company. This structure simplifies ownership for public-company deals and can streamline employee, tax and contract transitions. Depending on deal size and jurisdiction, regulators and shareholders may need specific approvals.

Buyers must match their financing to the risk and integration timetable. Lenders expect detailed financial models, pledges and contingency plans, whether you fund the purchase through bank debt, seller financing, mezzanine debt, private equity or public markets. The seller receives payment in one of four ways.

Negotiations frequently include tools that allocate risk to protect both parties. When they see risk, buyers push for tighter escrows and longer indemnity periods, while sellers look for limited escrows and caps on their liability. Clear definitions and objective measurement rules in the following can reduce post-close disputes.

Valuation is at the heart of every merger or acquisition. Buyers want to avoid overpaying, and sellers want a fair return — a credible valuation also reassures lenders, investors and boards. Because no single method works for all businesses, experienced teams consider several approaches and compare results to build a justifiable price. Involving the CFO early in the M&A process strengthens financial planning, improves valuation accuracy and mitigates integration risks.

The price-to-earnings ratio compares a company’s share price to its earnings. It is simple and widely used, and gives a quick snapshot of how the market values profitable, publicly traded companies.

To calculate it, divide the share price by earnings per share. For example, if a company’s share price is $50 and its earnings per share are $2, the P/E ratio is 25. If peers trade at a P/E of 20, the company appears more expensive.

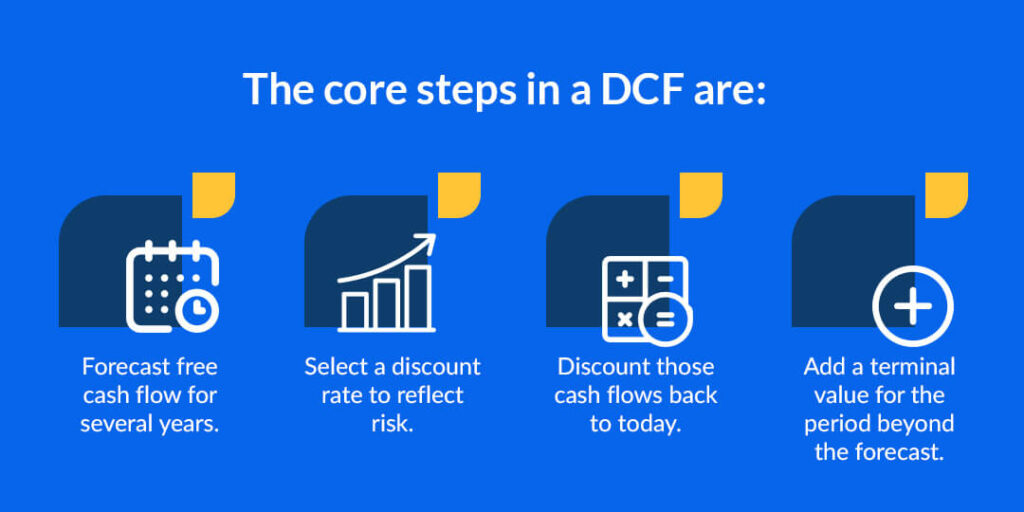

The discounted cash flow values a business based on the cash it expects to generate. This method captures the effect of growth and risk rather than relying on current profits.

The core steps in a DCF are:

The math reveals a business’s intrinsic value and shows how sensitive that value is to changes in assumptions, such as growth or margins. For example, if a buyer forecasts $1 million of free cash flow growing 5% annually at a 10% discount rate, they might arrive at an enterprise value near $15 million. Small changes in the discount rate can shift that value dramatically.

Professionals rarely rely on one model. They use market and transaction data to cross-check intrinsic values, which creates a range of values rather than a single number. It lays the foundation for negotiations, earnouts and financing discussions. Other valuation methods include the following.

Companies pursue mergers and acquisitions to achieve goals that might otherwise take years to reach. Well-planned deals can transform market position, improve profitability and open new growth paths. The most common motivations include entering new geographic regions, diversifying products or services, saving money or securing skilled employees, which is especially valuable in technical fields.

Each reason carries different risks. Cost savings require careful planning, and new technology can introduce hidden integration issues. Identifying the true strategic driver upfront confirms valuation, financing and integration plans.

M&A affects more than financial statements. Stakeholders experience genuine changes, and addressing these early smooths the transition. While they benefit from increased share value, dividends or liquidity, shareholders may see reduced returns from ownership dilution. Effective post-acquisition integration aligns people, processes and culture so promised synergies become measurable results. Clear communication and realistic projections maintain trust.

Employees face uncertainty about job security, reporting and benefits. Transparent communication, retention plans and fair treatment reduce turnover and maintain team member morale.

Cultural alignment often determines the deal’s success. Companies with mismatched values or leadership styles struggle to mesh. Planning for cultural integration, such as shared training, town halls and unified policies, supports long-term stability.

Business leaders considering an M&A often need to go beyond the fundamental questions before committing to a strategy. Addressing these queries early also clarifies when to bring in professional advisors who can protect your interests, accelerate timelines and find opportunities that internal teams might miss.

A chartered financial analyst designation isn’t mandatory for M&A professionals, but it signals strong analytical, financial modeling and valuation skills. Experience in investment banking, corporate finance and consulting is equally valuable. Many M&A advisors hold MBAs or accounting qualifications instead of or alongside the CFA.

While organizations can classify themselves how they see fit, there are three differences.

Due diligence is a structured investigation of a target company’s legal, financial, operational and strategic health. It validates assumptions and reveals risks before finalizing a transaction. Examples include verifying revenue streams, confirming customer contracts and assessing regulatory compliance. Skipping or rushing due diligence increases the chance of overpaying or inheriting hidden liabilities.

Working with an M&A advisory firm adds expertise, confidentiality and negotiation power to your transaction.

M&A can transform your business, but success depends on careful planning and expert execution. Working with an experienced advisory firm such as Synergy Business Brokers adds the market intelligence, confidentiality and negotiation skills you need to achieve favorable transaction terms and smooth transitions.

At Synergy Business Brokers, we wrote the mergers and acquisitions handbook. Since 2002, we have helped owners, buyers and investors achieve smooth, profitable transactions. Several ranking organizations have listed our team among the top 10 business brokers in the U.S. We also offer winning strategies for mergers, acquisitions and buyouts. Our team’s M&A services cater to small and midsized companies, with ample experience in larger business sales. We consistently sell businesses with annual revenues ranging from $700,000 to $250 million — and we only get paid when we sell your business.

Contact us today to discuss your goals and learn how our advisory services can guide you through every step of the process.