Blake Taylor

What Is the Best Way to Sell a Profitable Business?

Selling a profitable business is one of the most significant financial decisions you can make as a business owner. A …

7 MIN READ

Read More

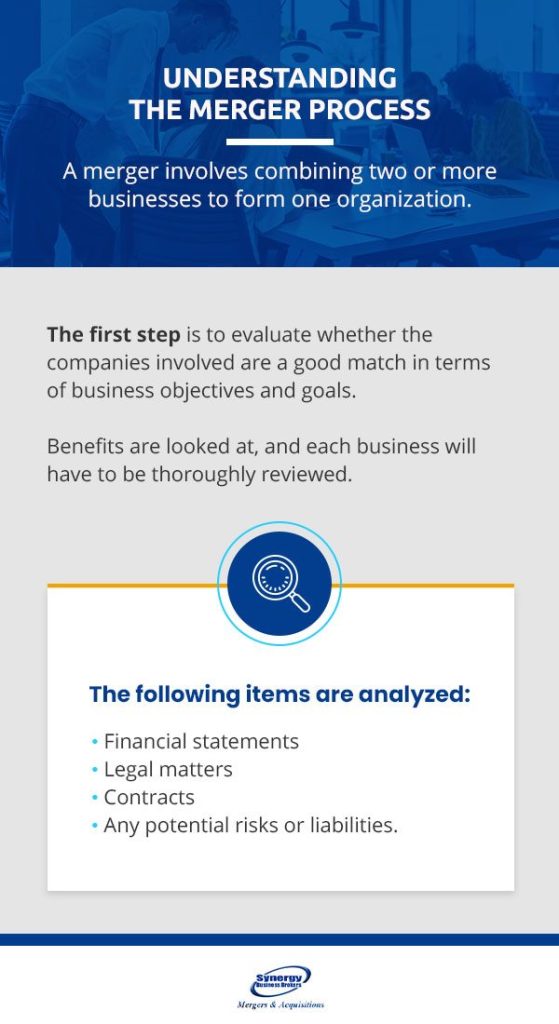

When deciding whether merging multiple businesses together is the right move for you and your companies, it helps to examine the pros and cons of mergers. Understanding what’s at stake and the potential advantages of your decision will help you choose the right option for your business. Let’s take a look at the merger process first.

A merger involves combining two or more businesses to form one organization. This is often done to achieve certain strategic goals, such as increasing the company’s reach in the market or improving overall efficiency. The first step is to evaluate whether the companies involved are a good match in terms of business objectives and goals. Benefits are looked at, and each business will have to be thoroughly reviewed. The following items are analyzed:

Once negotiations have taken place, the merger needs to get legal and regulatory approval. After that, a final document is created with all terms and conditions. The focus then shifts to what changes need to be made. The goal from this point forward is to ensure business continuity.

There are several advantages of merging a business.

Merging two companies offers the advantage of reducing the competition, especially when the companies are in the same sector or offer similar products. Instead of competing, they collaborate as a unified entity. By joining forces, they can command a larger market share than they could have as two separate companies.

To explore companies available for acquisition across the industries, click on the industry of your interest:

While it might appear at first glance that reduced competition benefits the merging entities rather than customers, you will be surprised how often customers benefit. For example, think about the merger of two competing mobile network companies. This combination can offer customers an expanded network with broader coverage.

In other scenarios, decreased competition can lead to streamlined services. The merger of two public bus or logistics companies could result in fewer buses operating simultaneously. This could be a disadvantage for the passenger, but it also leads to less traffic, congestion and confusion.

Another benefit of a merger is a reduction in costs. Budgets can be consolidated and staffing can be reduced. For example, when each company has its own marketing department, after a merger, they can combine the two departments into one to save money. Companies may also be able to reduce outside staffing, like cleaning services and security. Reduced costs internally can also allow companies to lower the prices of services or products, making them more affordable and competitively priced for the client.

Mergers between two companies often result in greater efficiency. For example, they can consolidate departments such as marketing and research and development. The departments can join forces and work together as a team toward a shared goal.

Each company has slightly different customer demographics. When the companies merge, they can join forces and potentially grow their customer base without extensive research.

One company could have branches or workers in different locations, which would allow the merging company to access those locations. They won’t have to undergo the usual process of finding employees in that area, looking for office space, or conducting surveys and research to find out what kind of market exists in that area. Each company brings resources, fresh data and new customers.

To view companies available for acquisition based on geography, please click on the state of interest: Connecticut businesses for sale, Indiana, Maryland, Massachusetts businesses for sale, Michigan, New Jersey businesses for sale, New York companies for sale, Ohio, Oklahoma, Pennsylvania businesses for sale, Tennessee, Texas businesses for sale.

Another advantage is sharing lessons learned and experiences. Perhaps one company has worked out an effective strategy to retain customers with a successful email campaign that increases the chance of a repeat sale. Maybe another company has found a cost-effective courier company. These trade secrets can be shared with one another to improve the business. These recommendations and insights after the merger allow new ways of approaching or thinking about problems.

Although a merger can offer many benefits to a company, it isn’t without disadvantages. Take a look at the disadvantages of a merger.

One of the major concerns for business owners during a merger is the potential clash of company cultures. The issue often arises if the merging entities have different management styles or expectations for employee conduct.

Such cultural clashes are not a foregone conclusion. Companies can work through the difficulties in aligning or managing differing expectations. By taking steps before and after the merger, businesses can facilitate a smoother transition for both teams. A process can be implemented for the business to troubleshoot the new policies and standards. Being prepared for downsides in an acquisition is a crucial aspect to plan for.

Employees know when something big is happening, and word slowly gets out. Many employees may have experienced something similar before and had a bad experience, and these employees may start getting nervous about their current positions. While there are times when mergers happen and positions are eliminated, a lot of the time, companies prefer to combine resources and skill sets.

Until the dust has settled and companies know which way the merger is going, their job productivity might dip, and they might not have as much motivation to do their work. In some cases, employees may opt to choose their own fate rather than wait for the merger to decide for them and may begin the process of changing jobs. There have been mergers where companies have lost a fair amount of their workforce during the anticipation phase.

A merger can result in an increase in overall liability, depending on the amount of debts each company has coming in. This can disrupt the merger’s ability to get more or new credit. More liability raises challenges that can be difficult at the onset, but over time, this will lessen, and the ultimate growth opportunities of the merger could outweigh the initial liability issues.

In business, every choice comes with a set of advantages and disadvantages. You will have to weigh the pros and cons to decide if the benefits outweigh the drawbacks or vice versa.

Often, the benefits outweigh the potential drawbacks. By carefully planning and starting the planning early, most challenges can be managed. For example, steps can be taken in advance to align different company cultures, creating a more cohesive environment.

If either company involved is dealing with debt, strategies can be implemented to lower these liabilities. The result is a strengthening of the financial foundation, which would be an unexpected advantage! Other examples of benefits include inspiring innovation, addressing a company’s weaknesses and bringing out its strengths.

While merging with another company is a powerful strategy, it isn’t the only path you can take. Here are a few alternative strategies that offer similar benefits:

If you are looking to grow through mergers and acquisitions, please view our businesses for sale. You can also contact us online, and we will support you through the process of finding companies, merging and getting to your business goals. Start the process of getting your company acquired by contacting us today!