Blake Taylor

What Is the Best Way to Sell a Profitable Business?

Selling a profitable business is one of the most significant financial decisions you can make as a business owner. A …

7 MIN READ

Read More

Selling your business is a significant milestone. It can represent your hard work and dedication, leading to a well-deserved break or new opportunities. However, the process can be complex, requiring careful planning for a successful transaction. Before you start pushing for the sale, though, there are a few things you need to consider when selling your company.

Some are financial, some are emotional, and some involve the business sales process. Having worked with sellers for almost 20 years, we have many insights into this area and can give you some factors to consider before you decide to sell your company. This can help you minimize regrets, have a more productive sales process and hand off your business to the buyer more effectively.

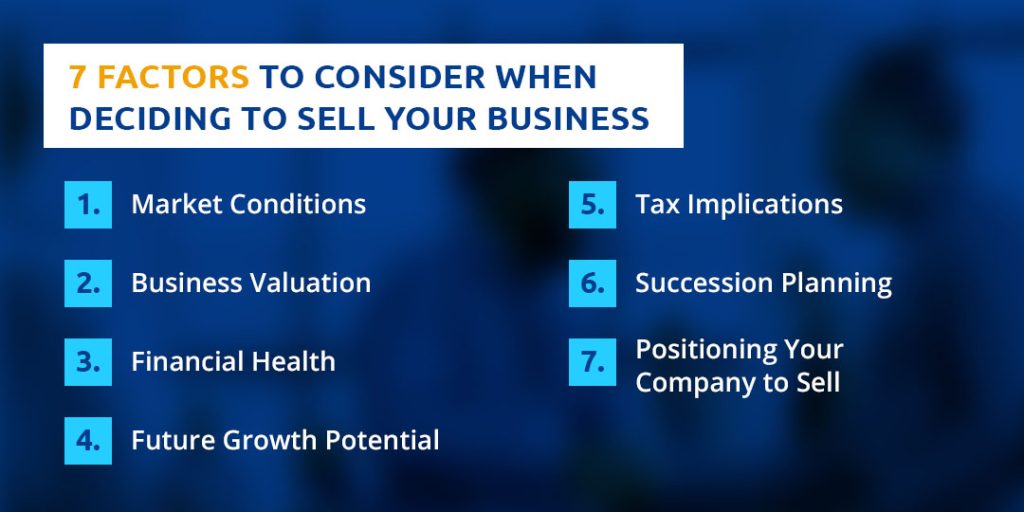

The first step in selling a business is the decision of whether to sell your business or not. Are you driven by the desire to retire, do you want to capitalize on the value of the organization you’ve built, or are you just ready for a new venture? There are several key factors to consider to ensure you make the right decision for your personal goals and financial future:

Understand the current market environment to ensure you get the best price for your business. Selling in a strong market can lead to a higher valuation, while a downturn often means selling at a lower price. Having a grasp of the market conditions lets you know when it’s the right time to sell.

How do you prepare a company to sell? Start with getting an accurate business valuation to ensure you know what it’s worth. A professional valuation considers your market position, growth potential, assets, revenue and liabilities. This knowledge helps you set realistic expectations and ensure you get fair compensation.

Look into your business’s financial health, including your cash flow, profitability and debt levels. You can attract more buyers and get better offers with a strong financial position.

With the information about your business’s financial health potential and market considerations, consider your business’s future growth potential. A significant upside might convince you to hold onto the business for longer until this potential can be reflected in the sale price.

Consult with tax professionals to understand what implications you face when you want to sell your business. Consider how the sale structure, like an asset sale versus a stock sale, will impact your tax liabilities and your ongoing legal obligations post-sale.

Consider what will happen after you sell — will you stay on for the transition period? Preparing for life after you sell your business can help secure a smoother transition and personal satisfaction when you complete the transaction.

Are you considering passing your business on to your children? A lot of business owners do this, and it can work out well. It is important to think carefully about this because sometimes the children have other careers and don’t want to own the business. In other cases, they may not have the skills to operate the company. Ideally, before having your children take over the company, you would want to have them work in the business and get some confidence that they have the skills and desire to run the company when you are no longer working there. Read our article on deciding whether to pass your business on to your children for a better overview of this topic.

If your children aren’t a consideration, you can also decide to sell your business to an employee. This can be a good option; however, the employee may not have the funds or experience to purchase your business. If that’s the case, then you can consider the opportunity to have a business broker find a well-funded and experienced buyer

If you are getting ready to sell, start by identifying and highlighting your business’s unique selling points. It is important to showcase your industry leadership through market share, innovations, operational efficiency and customer loyalty. Present potential buyers with clear growth opportunities like new product development, expanding existing services or entering new markets. Make sure the business adheres to all relevant laws and regulations, with all permits, licenses and intellectual property in place.

Partnering with the right merger and acquisition firm can help set you on the right path, allowing you to sell your business for its true market value.

Aside from assessing market conditions, it is important to evaluate your readiness — you need to approach this decision with a clear understanding of your motivations. It can be a good idea to start with this assessment and then move on to the other factors when you are sure you want to sell for the right reasons.

There are a lot of reasons that people consider selling their company. If the only reason is that someone contacted you and said they were interested in buying your business, then that’s not reason enough to sell on its own.

If you have a business that isn’t making any money, that’s a common reason to sell. However, if you have a profitable business and money is the only reason you want to sell, then that’s usually not a strong enough reason to cause you to sell your company. Typically, you need to have a compelling reason or reasons to sell, such as you:

Money is certainly a factor in deciding to keep your business. If you own a profitable company, you may rely on the income it generates to support you. Unless you own a tech company, most businesses sell for two to four times the annual net earnings of a business. So if you enjoy working at your business and don’t have another compelling reason to sell mentioned above, it usually makes sense to continue holding onto the company.

However, you may enjoy the business itself but may have problems with a partner or other issues that are contributing to your lack of desire to work at the company. If this is a major problem, it can be a factor in deciding to sell your business.

We have spoken with several business owners who had compelling reasons to sell their businesses. However, some of them are not emotionally prepared to sell their company. Before you consider selling, you need to really think about whether you are ready to sell. The last thing you want to do is prepare your business for sale, talk to buyers, and then back out and waste your and the buyer’s time.

Unfortunately, this does happen sometimes. Most sellers do find it challenging to let go of their business. That’s normal. But you need to consider whether your reasons for selling outweigh your emotions for keeping the company. If so, then you are probably ready to sell.

One thing that helps sellers adjust to the idea of selling is to find a buyer that they are comfortable with taking over their business, one that will treat their customers and employees well. An experienced business broker can help you find the right buyer for your business.

If you are experiencing health problems, this can be a deciding factor in an owner selling their business. You may decide that the stress of running your business is contributing to your health problems, and it’s time to focus your primary efforts on resting and getting well.

Keep in mind that buyers will need to find out more about the company to finalize a purchase. Business brokers can help greatly reduce the amount of work you must do. However, an owner or someone with knowledge of the company will need to provide information on the business to allow buyers to be informed enough to purchase a business.

We have sold businesses where the owner has a major health issue or even passed away. We worked with a family member, accountant and attorney in providing information to the buyer. It is one of the least desirable reasons to sell a business, but it is part of life and is a compelling reason to sell.

This can fit in with the decision of whether to provide your business to your children or sell to an employee. In some cases, financially, you may be better off selling to a third party. Whether or not you are considering your children for the business, you still need to know how much money you will need from the sale of the company to retire, buy another business or make whatever life change you want to make.

A business broker can give you an idea of how much you can expect to get from the sale of your business. Once you have this information, you can decide whether or not it will be enough to meet your needs. You need to factor in paying taxes on the sale of the business, your lifestyle and more. If it’s not enough, then you may want to work some more and try to build up the company’s net income to sell the company for a more substantial amount.

Keep in mind that it typically takes six to 10 months to sell a business so you will have income during that time. You also want to allow some time to do a transition with the buyer. In some cases, you may be with the buyer for a while and collecting a salary during the transition period. There are many different options when selling a business, and a business broker can talk through some of the potential scenarios and advise you on the right time to begin selling your company.

Having a manager run your business might be a good option for some people. If you have a manager working in the company that can handle your role in the business, then this may work out well for you. If you don’t have a manager internally, then you can consider hiring or training someone to handle your roles.

However, there are risks involved in each of these strategies. If the business doesn’t perform as well, this will decrease your income and reduce the value of the sale of your business. Even if the manager is skilled, changes in the marketplace may cause your business to decline. Some business owners prefer to sell the company to move on to the next phase of their lives without worrying about the business that someone else is managing but still owns.

After you have considered the factors involved in selling your business, it is good to take a holistic approach and digest all the information to see if you are ready to sell, taking into account your finances, emotions and plans for the future. You can discuss the decision with your family and friends, examine the options with a business broker, and see if you are prepared to start the process.

No plans are cast in concrete, but it is wise to have a general idea of what you are going to do. For example, are you planning on retiring and pursuing other activities or spending more time with friends and family? Perhaps you want to travel or have another business opportunity you will spend time on. Another common reason for selling a business is the desire or need to relocate.

Of course, taking some time off and doing less is fine. That’s one of the freedoms that come with selling your company. It’s just good to have an idea of what you can do if you get bored or your plans don’t work out the way you envision them.

We are the #1 Rated Business Broker nationwide in a couple of categories. We have been in business for 18 years and have developed contacts with over 30,000 potential buyers during that time. We’re not the right business broker for everyone. We only focus on selling companies in construction, technology, manufacturing, healthcare, services, distribution, engineering, education and transportation. Within these industries, we represent profitable companies with annual revenue of $700,000 to $70 Million.

If you own a company that fits these criteria, we would be happy to discuss your options with you and see if the timing might be right for you to start the business sale process. Fill out our online form or call (888)-688-4664. One of our Senior M&A Brokers in New York, New Jersey, Connecticut, Massachusetts, Pennsylvania, Texas, or New Mexico looks forward to connecting with you. We sell businesses throughout the East, South and Midwest. Our potential buyers come from all 50 states and dozens of different countries. You can listen to some of our clients and Brokers in the following video.